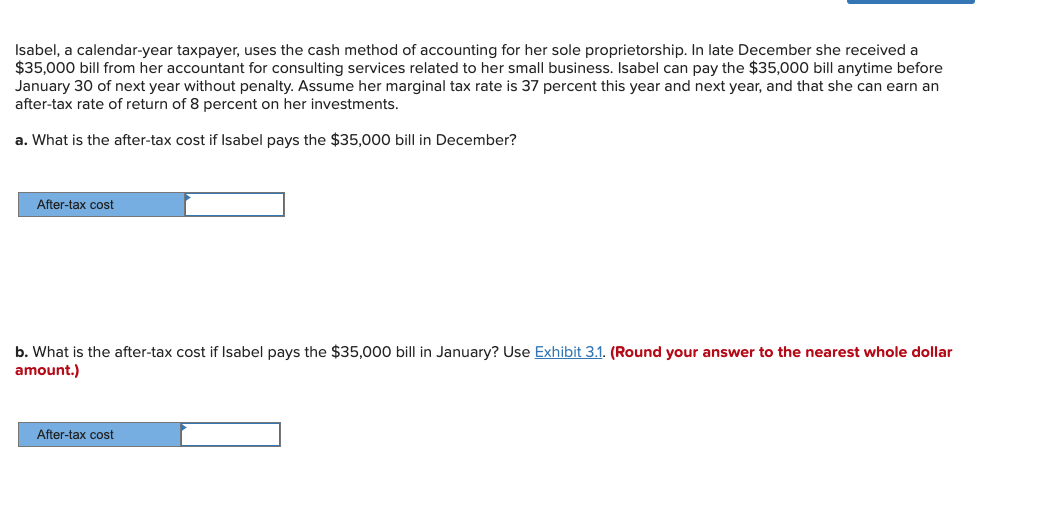

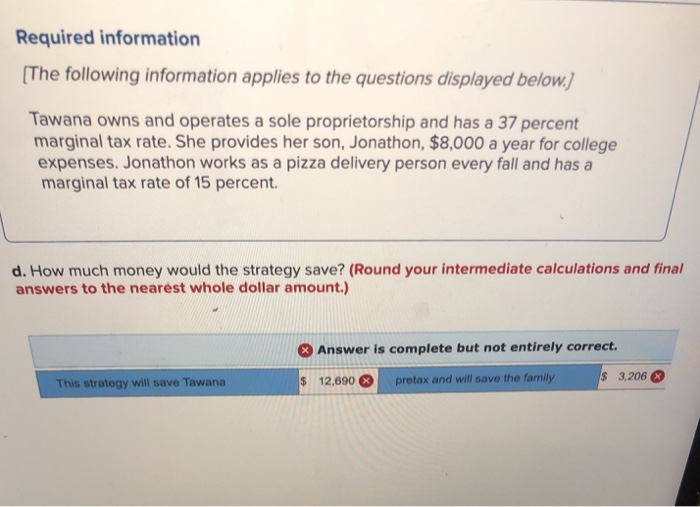

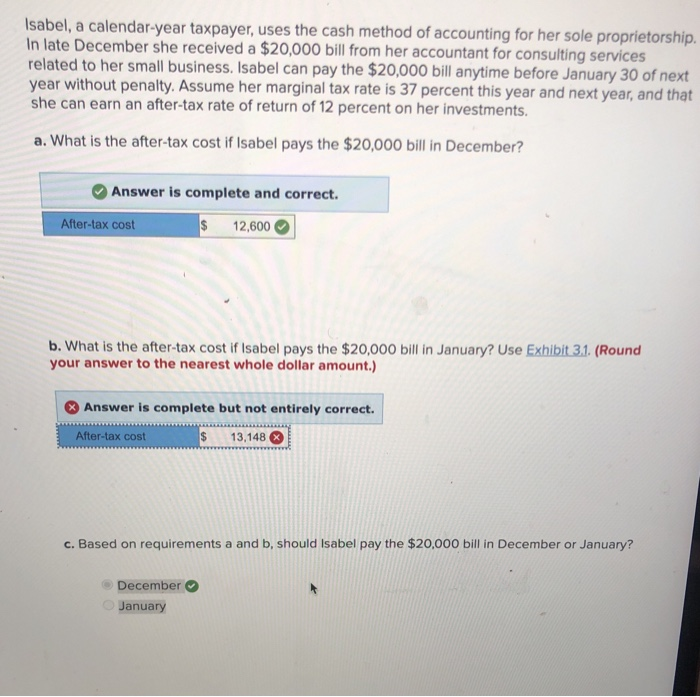

Isabel A Calendar Year Taxpayer - In late december she received a $20,000 bill from her. Assume her marginal tax rate is. In late december she received a $34,000 bill from her. Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty.

Solved Isabel, a calendaryear taxpayer, uses the cash

In late december she received a $20,000 bill from her. Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is.

Solved Isabel, A Calendaryear Taxpayer, Uses The Cash Me...

Assume her marginal tax rate is. Assume her marginal tax rate is. In late december she received a $20,000 bill from her. In late december she received a $34,000 bill from her. Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty.

Solved Isabel, a calendaryear taxpayer, uses the cash

Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. In late december she received a $34,000 bill from her. Assume her marginal tax rate is. Assume her marginal tax rate is. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty.

Solved Isabel, A Calendaryear Taxpayer, Uses The Cash Me...

Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is. In late december she received a $34,000 bill from her. In late december she received a $20,000 bill from her.

Solved Ashley, a calendar year taxpayer, owns 400 shares of

Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. In late december she received a $34,000 bill from her. Assume her marginal tax rate is. Assume her marginal tax rate is. Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty.

Solved Isabel, A Calendaryear Taxpayer, Uses The Cash Me...

Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is. In late december she received a $20,000 bill from her. In late december she received a $34,000 bill from her. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty.

Isabel, a calendaryear taxpayer, uses the cash method of accounting

Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is. In late december she received a $34,000 bill from her. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. In late december she received a $20,000 bill from her.

Solved Isabel, A Calendaryear Taxpayer, Uses The Cash Me...

Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. In late december she received a $20,000 bill from her. Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. In late december she received a $34,000 bill from her. Assume her marginal tax rate is.

Solved Isabel, a calendaryear taxpayer, uses the cash

Assume her marginal tax rate is. In late december she received a $20,000 bill from her. Assume her marginal tax rate is. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. In late december she received a $34,000 bill from her.

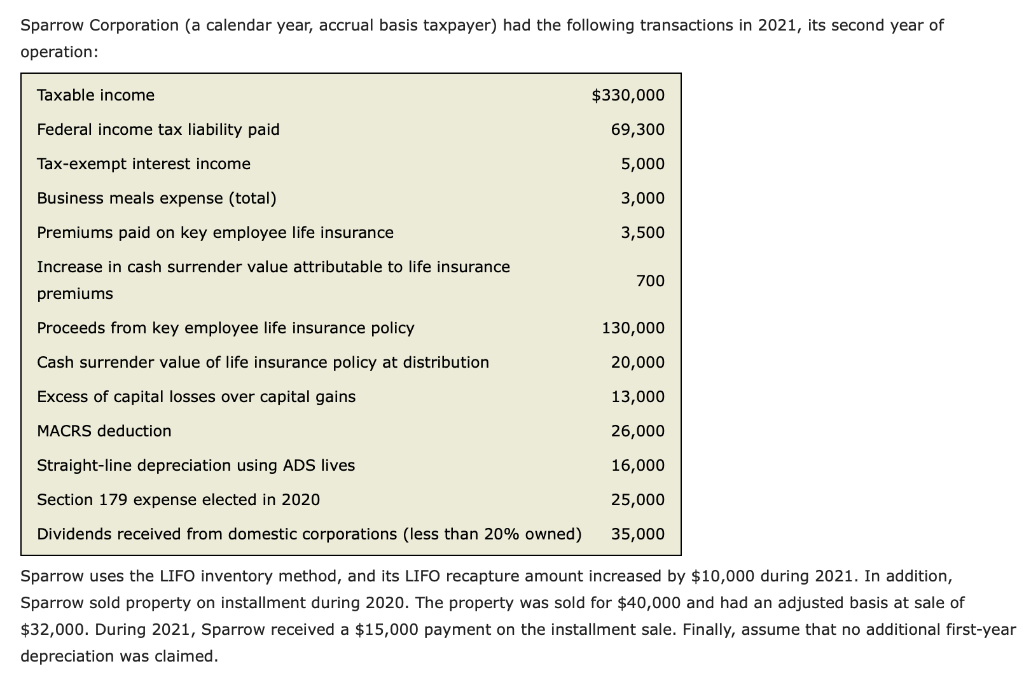

Solved Sparrow Corporation (a calendar year, accrual basis

Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is. In late december she received a $34,000 bill from her. Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. In late december she received a $20,000 bill from her.

Web isabel can pay the $43,000 bill anytime before january 30 of next year without penalty. Assume her marginal tax rate is. Web isabel can pay the $34,000 bill anytime before january 30 of next year without penalty. In late december she received a $20,000 bill from her. In late december she received a $34,000 bill from her. Assume her marginal tax rate is.

Web Isabel Can Pay The $34,000 Bill Anytime Before January 30 Of Next Year Without Penalty.

Assume her marginal tax rate is. In late december she received a $20,000 bill from her. In late december she received a $34,000 bill from her. Assume her marginal tax rate is.