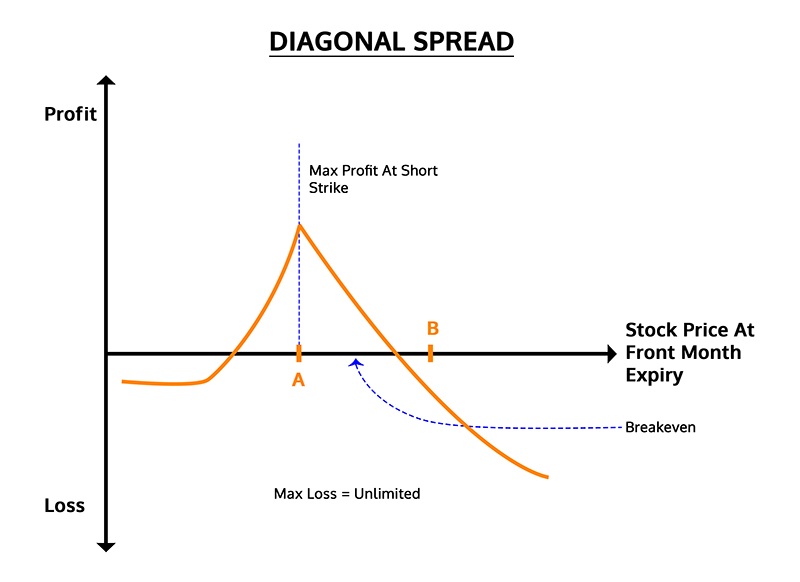

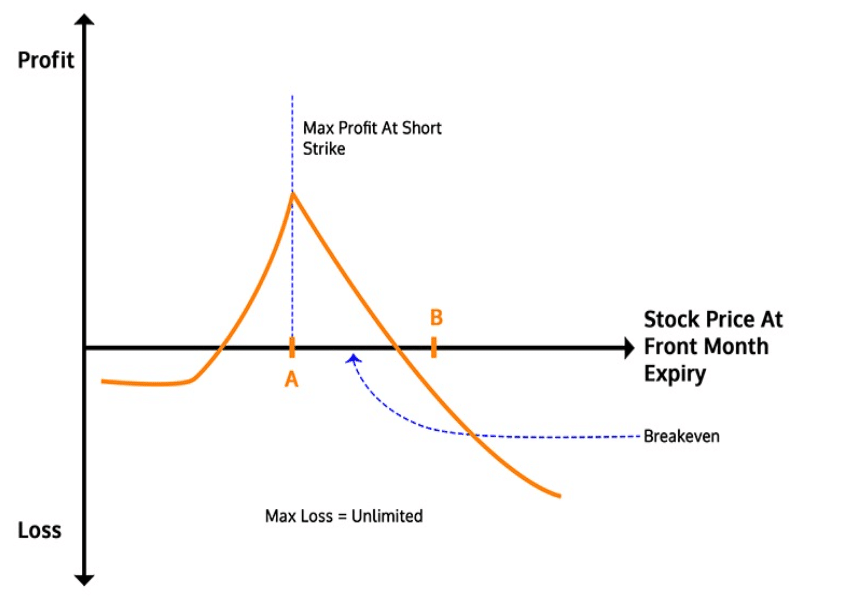

Diagonal Calendar Spread Option Strategy - Web to better understand the diagonal call calendar spread, an option spread is constructed by buying an option and. Calendar spreads and diagonal spreads have many. Web the first is about diagonal spreads as a strategy —how and why you might put on a diagonal. Combines bits of both long call. And then there’s the diagonal. Web diagonal spread strategy is: Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web when to use a calendar spread vs. Web short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both puts have the same expiration date. It’s a cross between a long calendar spread with puts and a short put.

Diagonal Spread Options Trading Strategy In Python

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web diagonal spread strategy is: Web when to use a calendar spread vs. And then there’s the diagonal. Web key takeaways there are many options strategies available to help reduce the risk of market.

Diagonal Call Calendar Spread Smart Trading

Options strategy management tastylive 320k subscribers subscribe 1k share 39k views. The calendar spread is one. Web the options institute at cboe ® potential goal to profit from neutral stock price action between the strike prices of the short calls with limited risk. Web short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which.

Free Forex News Indicator Diagonal Spread Options Strategy

Web when to use a calendar spread vs. Web a diagonal spread is an options strategy established by simultaneously entering into a long and short position in. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web to better understand the diagonal call calendar spread, an option spread is constructed by.

Options SpreadTrading Focus Combining Verticals and Calendars

Options strategy management tastylive 320k subscribers subscribe 1k share 39k views. Web a call diagonal spread is a combination of a call credit spread and a call calendar spread. Calendar spreads and diagonal spreads have many. Combines bits of both long call. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections.

Diagonal Call Calendar Spread Smart Trading

Web if two different strike prices are used for each month, it is known as a diagonal spread. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web key takeaways there are many options strategies available to help reduce the risk of.

Long Call Diagonal Spread An Advance Option Strategy MarketXLS

Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web diagonal spread strategy is: Web a call diagonal spread is a combination of a.

When Calendar Met Vertical A Diagonal Spread Tale Ticker Tape

Web a call diagonal spread is a combination of a call credit spread and a call calendar spread. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Combines bits of both long call. And then there’s the diagonal. Web the options institute at.

An Option Strategy That Pays While You Wait [Calendar Diagonal Option

Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. And then there’s the diagonal. Web a diagonal spread is an options strategy established by simultaneously entering into a long and short position in. Web if two different strike prices are used for.

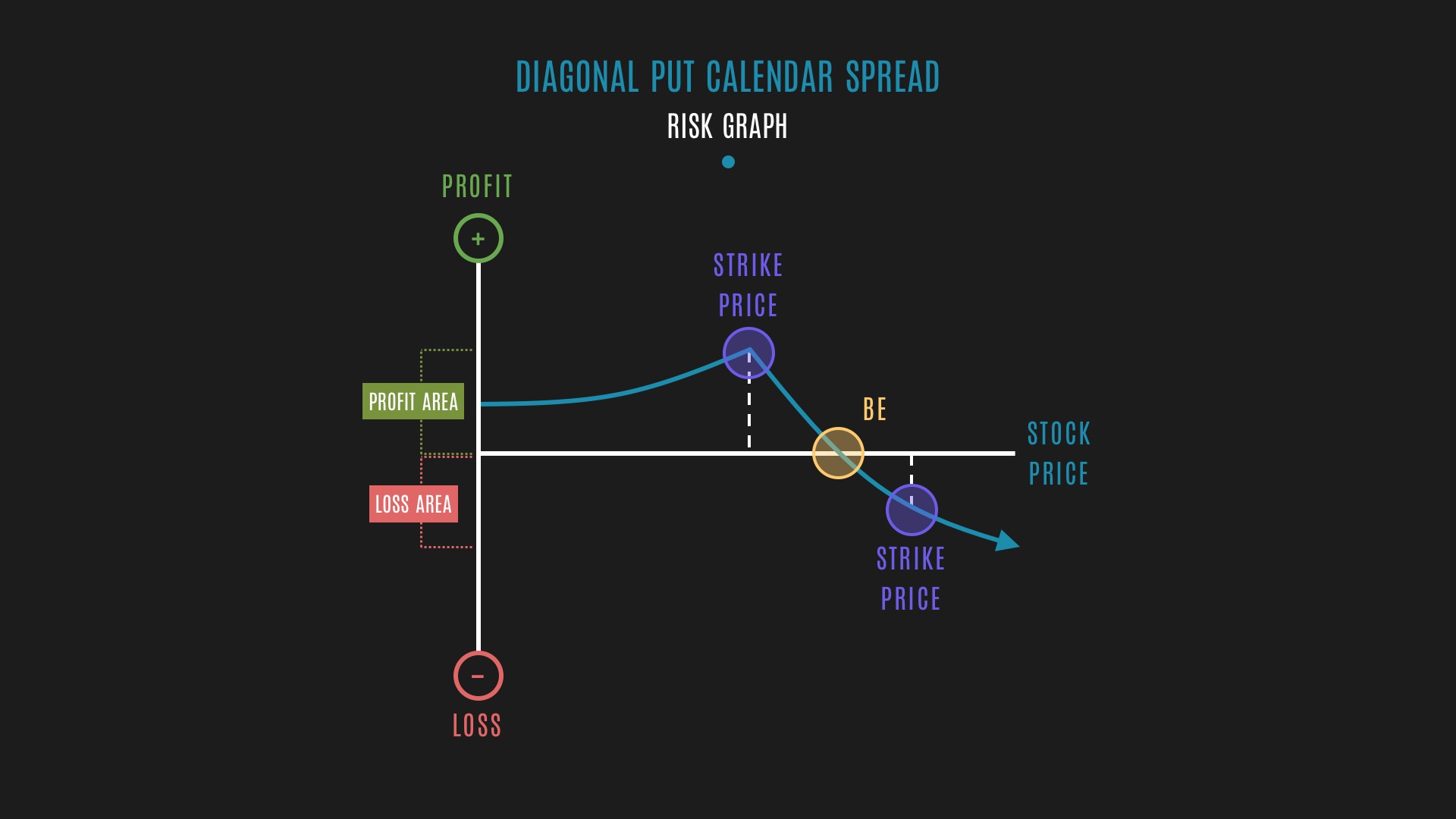

Glossary Diagonal Put Calendar Spread example Tackle Trading

Options strategy management tastylive 320k subscribers subscribe 1k share 39k views. Web key takeaways the diagonal spread strategy in options trading involves buying and selling options of the same type but at different. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web.

Options Trading Made Easy Diagonal Spread

Web key takeaways the diagonal spread strategy in options trading involves buying and selling options of the same type but at different. Web a diagonal spread is an options strategy established by simultaneously entering into a long and short position in. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; Web to.

Calendar spreads and diagonal spreads have many. Web the strategy got its name based on how it combines a calendar spread (also known as horizontal spread), with different. It’s a cross between a long calendar spread with puts and a short put. Web key takeaways the diagonal spread strategy in options trading involves buying and selling options of the same type but at different. Web the first is about diagonal spreads as a strategy —how and why you might put on a diagonal. Web to better understand the diagonal call calendar spread, an option spread is constructed by buying an option and. Web diagonal spread strategy is: Web if two different strike prices are used for each month, it is known as a diagonal spread. Web the options institute at cboe ® potential goal to profit from neutral stock price action between the strike prices of the short calls with limited risk. The calendar spread is one. Web a call diagonal spread is a combination of a call credit spread and a call calendar spread. Web key takeaways there are many options strategies available to help reduce the risk of market volatility; And then there’s the diagonal. Options strategy management tastylive 320k subscribers subscribe 1k share 39k views. Web when to use a calendar spread vs. Combines bits of both long call. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at. Web short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both puts have the same expiration date. Web a diagonal spread is an options strategy established by simultaneously entering into a long and short position in.

It’s A Cross Between A Long Calendar Spread With Puts And A Short Put.

The calendar spread is one. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of. Web a diagonal spread is an options strategy established by simultaneously entering into a long and short position in. Web short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both puts have the same expiration date.

Web To Better Understand The Diagonal Call Calendar Spread, An Option Spread Is Constructed By Buying An Option And.

Web the strategy got its name based on how it combines a calendar spread (also known as horizontal spread), with different. And then there’s the diagonal. Web a call diagonal spread is a combination of a call credit spread and a call calendar spread. Web the first is about diagonal spreads as a strategy —how and why you might put on a diagonal.

Web Key Takeaways The Diagonal Spread Strategy In Options Trading Involves Buying And Selling Options Of The Same Type But At Different.

Web diagonal spread strategy is: Web key takeaways there are many options strategies available to help reduce the risk of market volatility; Web the options institute at cboe ® potential goal to profit from neutral stock price action between the strike prices of the short calls with limited risk. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at.

Web If Two Different Strike Prices Are Used For Each Month, It Is Known As A Diagonal Spread.

Web when to use a calendar spread vs. Combines bits of both long call. Calendar spreads and diagonal spreads have many. Options strategy management tastylive 320k subscribers subscribe 1k share 39k views.