Double Diagonal Calendar Spread - It’s a cross between a long calendar spread with calls and a short call spread. 1) when in doubt, adjust. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Double diagonal spreads can be. Web double calendar vs double diagonal. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Web both double calendars and double diagonals have the same fundamental structure; Web in today's video i want to talk about the double calendar spread strategy that can be very powerful on robinhood. Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Download the 12,000 word guide.

Double Calendar Spreads LaptrinhX

Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web double diagonal calendar spread is an advanced options trading strategy that aims to minimize risk and. Download the 12,000 word guide. Web really, a double diagonal is an iron condor, plus a put calendar and a call calendar. Web the istanbul diagonal calendar strategy is.

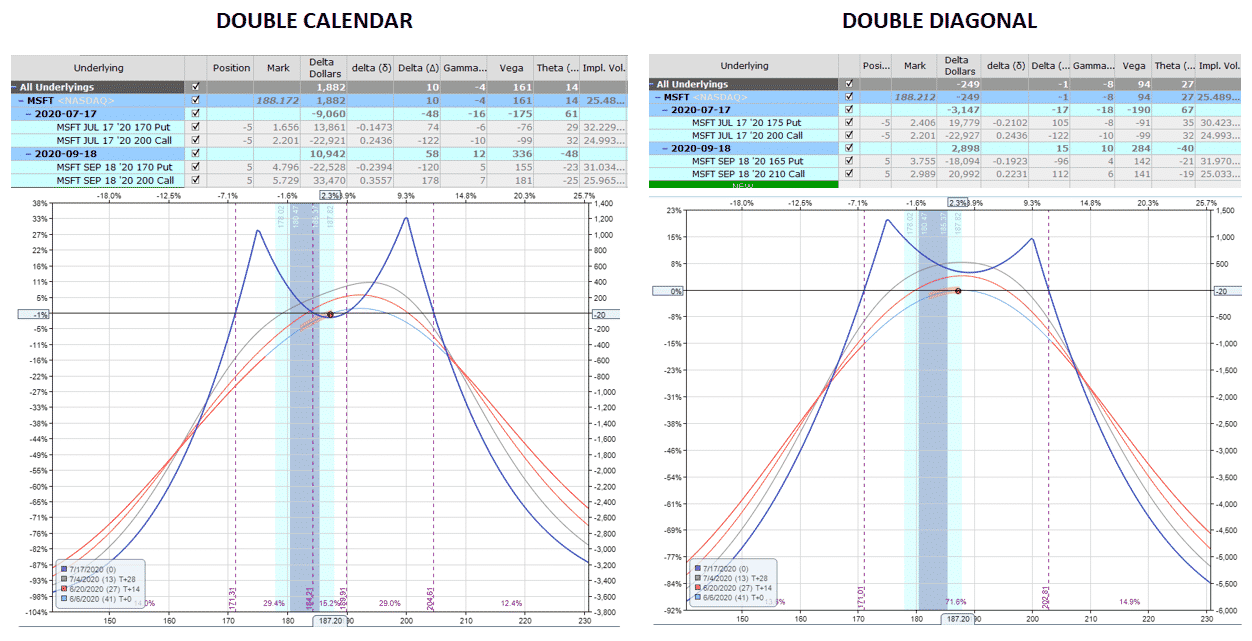

Case Study Goldman Sachs Double Calendar and Double Diagonal

Web similar to a double calendar spread, we may establish two diagonal spreads, one positioned above the current index or. Web the following rules should be adhered to when using the calendar/diagonal spread strategy: 1) when in doubt, adjust. Web double calendar vs double diagonal. Web double diagonal calendar spread is an advanced options trading strategy that aims to minimize.

Pin on Double Calendar Spreads and Adjustments

Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical. Each is short option contracts in. Web a diagonal with two calls is a call diagonal spread (see figure 1). Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Double diagonal spreads can be.

Pin on Double Calendar Spreads and Adjustments

A put diagonal spread has two puts. • start with a 37/38/42/43 iron. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying. Web both double calendars and double diagonals have the same fundamental structure; Web double diagonal spreads can be described in two ways.

DOUBLE DIAGONAL CALENDAR SPREAD STRATEGY TRADING PLUS YouTube

Download the 12,000 word guide. A put diagonal spread has two puts. Web a diagonal spread is a modified calendar spread involving different strike prices. Web similar to a double calendar spread, we may establish two diagonal spreads, one positioned above the current index or. A calendar spread is an options or.

Double Calendar Spreads Ultimate Guide With Examples

Web double diagonal spreads can be described in two ways. Each is short option contracts in. Web double calendar vs double diagonal. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Web both double calendars and double diagonals have the same fundamental structure;

Pin on CALENDAR SPREADS OPTIONS

1) when in doubt, adjust. A calendar spread is an options or. Download the 12,000 word guide. Web the istanbul diagonal calendar strategy is one of the most profitable of the seven deadly strategies series. It’s a cross between a long calendar spread with calls and a short call spread.

Pin on CALENDAR SPREADS OPTIONS

Web double calendar vs double diagonal. Download the 12,000 word guide. Web double diagonal spreads can be described in two ways. Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an. Web in today's video i want to talk about the double calendar spread strategy that can be very powerful on.

Pin on Calendar Spreads Options

It is an options strategy established by. Web double diagonal spreads can be described in two ways. Web a diagonal spread is a modified calendar spread involving different strike prices. Web the istanbul diagonal calendar strategy is one of the most profitable of the seven deadly strategies series. Download the 12,000 word guide.

Pin on Double Calendar Spreads and Adjustments

Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Download the 12,000 word guide. It is an options strategy established by. Web similar to a double calendar spread, we may establish two diagonal spreads, one positioned above.

A calendar spread is an options or. Double diagonal spreads can be. Web in today's video i want to talk about the double calendar spread strategy that can be very powerful on robinhood. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying. Web a diagonal with two calls is a call diagonal spread (see figure 1). • start with a 37/38/42/43 iron. It is an options strategy established by. Each is short option contracts in. Web both double calendars and double diagonals have the same fundamental structure; Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an. Web the double calendar spread and the double diagonal spread are two popular option trading strategies with the. Download the 12,000 word guide. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical. Web double calendar vs double diagonal. It’s a cross between a long calendar spread with calls and a short call spread. Web similar to a double calendar spread, we may establish two diagonal spreads, one positioned above the current index or. Web double diagonal spreads can be described in two ways. Web the istanbul diagonal calendar strategy is one of the most profitable of the seven deadly strategies series. A put diagonal spread has two puts. Web double diagonal calendar spread is an advanced options trading strategy that aims to minimize risk and.

Web The Istanbul Diagonal Calendar Strategy Is One Of The Most Profitable Of The Seven Deadly Strategies Series.

Web updated february 13, 2021 reviewed by gordon scott what is a calendar spread? Web the following rules should be adhered to when using the calendar/diagonal spread strategy: Web in today's video i want to talk about the double calendar spread strategy that can be very powerful on robinhood. Web a double calendar spread is a trading strategy used to exploit time differences in the volatility of an.

Web Double Diagonal Calendar Spread Is An Advanced Options Trading Strategy That Aims To Minimize Risk And.

It is an options strategy established by. • start with a 37/38/42/43 iron. Download the 12,000 word guide. Web double calendar vs double diagonal.

It’s A Cross Between A Long Calendar Spread With Calls And A Short Call Spread.

Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying. Web a diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical. 1) when in doubt, adjust. Web double diagonal spreads can be described in two ways.

Web A Diagonal Spread Is A Modified Calendar Spread Involving Different Strike Prices.

Web similar to a double calendar spread, we may establish two diagonal spreads, one positioned above the current index or. Web both double calendars and double diagonals have the same fundamental structure; Each is short option contracts in. A put diagonal spread has two puts.